The Conservatives have always tried to be the party that supports businesses to set up and grow.

In the 1980s, our Enterprise Allowance Scheme saw 325,000 people get the help and support needed to set up their own business.

If our public services, such as schools, the NHS and police, are to have the taxes they need, then we also need a successful private sector to unlock the investment, growth and opportunities of the future.

Since 2010, the Conservative Governments have changed the tax system and improved the support available for businesses.

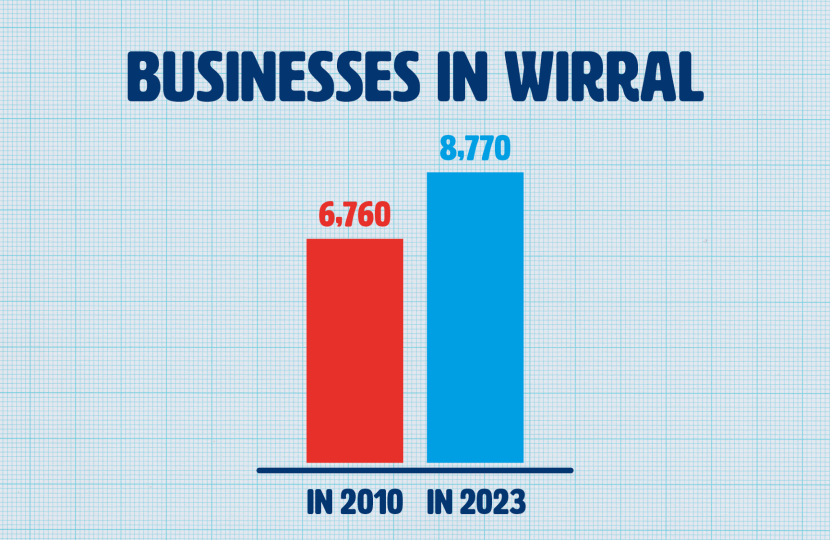

In Wirral, these changes have supported the initiative, commitment and determination of more than 2,000 people to set up business here. Many now employ staff and apprentices. There are now 8,770 businesses in Wirral.

That is why a tax system that incentivises business to invest is at the heart of our economic plan. We introduced the biggest business tax cut in modern British history, which hundreds of business leaders have described as the ‘single most transformational’ measure for growth and investment.

So more businesses can benefit, we will look to extend our ‘full expensing’ policy to leasing, once the fiscal conditions allow. And we will not raise corporation tax.

For the very smallest businesses, the four million people who are self-employed, we will abolish the main rate of National Insurance entirely by the end of the next Parliament.

A record of action...

- We are supporting firms with a business rates support package worth £4.3 billion over the next five years to support small businesses

- and the high street.

- We want small businesses to get a bigger share of public contracts and have improved the public sector procurement system to that end.

- We have made it easier and cheaper for small businesses to hire an apprentice.

- And we have taken 28,000 small businesses out of paying VAT altogether by raising the VAT registration threshold to £90,000.

...and a promise of more

In the next Parliament, we will deliver a ten point plan to support small and medium sized businesses in Wirral:

-

Continue to ease the burden of business rates for high street, leisure and hospitality businesses by increasing the multiplier on distribution warehouses that support online shopping over time.

- Keep the VAT threshold under review and explore options to smooth the cliff edge at £90,000.

- Improve access to finance for SMEs including through expanding Open Finance and by exploring the creation of Regional Mutual Banks.

- Take more companies out of the scope of burdensome reporting requirements. Making use of freedoms granted by Brexit, we will lift the employee threshold allowing more companies to be considered medium-sized. This is expected to save small businesses at least one million hours of admin per year.

- Retain key tax incentives that encourage small businesses to grow, including the Enterprise Investment Scheme, Seed Enterprise Investment Scheme, Venture Capital Trusts, Business Asset Disposal Relief, Agricultural Property Relief and Business Relief. We will not increase Capital Gains Tax.

- Promote digital invoicing and improve enforcement of the Prompt Payment Code to support small businesses with the perennial challenge of cashflow, building on our creation of the Small Business Commissioner with powers to tackle unfavourable payment practices.

- Ensure that Basel III capital requirements do not inhibit lending to SMEs.

- Continue our world leading programmes including the Invest in Women Task Force and the Lilac Review to encourage more female and disabled entrepreneurs.

- Work with the British Business Bank and private sector fund managers to secure a £250 million Invest In Women Fund to support female entrepreneurs.

- Work with public sector organisations including local authorities and NHS trusts and companies benefitting from government contracts to ensure that procurement opportunities are focused on SMEs in their local economies where possible and practical.